Use these links to rapidly review the document

TABLE OF CONTENT

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o | ||

Check the appropriate box: | ||

Preliminary Proxy Statement | ||

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

Definitive Proxy Statement | ||

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| Equitrans Midstream Corporation | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

March 8, 2021

Fellow Shareholders, |

On behalf of the Board of Directors and management of Equitrans Midstream Corporation, I am pleased to invite you to participate in our third annual meeting of shareholders on Tuesday, April 27, 2021, at 9:00 a.m. (ET), to be held virtually via live webcast at www.virtualshareholdermeeting.com/ETRN2021. Given the ongoing public health considerations associated with COVID-19, and because the health, safety, and well-being of our employees and shareholders is of utmost importance to us, conducting our meeting virtually will enhance shareholders' ability to participate, vote, and ask questions during the annual meeting in a safe and efficient manner.

Equitrans Midstream began operations as an independent, public company in November 2018 and our common stock is traded on the New York Stock Exchange under the symbol "ETRN." Your continued interest in and support of our Company is invaluable and receiving shareholder feedback is instrumental to our future success.

This year you will be asked to vote on several items at the annual meeting, including the election of directors, approval of our executive compensation program for 2020 (the say-on-pay vote), approval of amendments to our Articles of Incorporation and Bylaws to remove the supermajority voting requirements, and ratification of the appointment of our independent registered public accounting firm for 2021. The proxy statement describes these items in more detail. Your vote is important — please read the proxy materials and follow the voting instructions to ensure your shares are represented at the meeting.

Whether or not you plan to participate in the annual meeting, please vote as soon as possible — by telephone, via the Internet, or by completing and signing your paper proxy card or vote instruction form — to ensure that your shares are represented and voted.

We move the energy that keeps America moving and our mission is simple — to provide safe, reliable, and innovative infrastructure solutions for the energy industry. The principles that guide our behaviors and decisions are based on our five core values: safety, integrity, collaboration, transparency, and excellence. With these values in mind, we will:

I look forward to reporting on our progress and many successes during the annual meeting, including efforts to enhance our Environmental, Social, and Governance platform; and the publication of our first annual Corporate Sustainability Report, produced in accordance with the Global Reporting Initiative and the Sustainability Accounting Standards Board Oil & Gas — Midstream Standards. Thank you for your investment in Equitrans Midstream Corporation and your participation in our annual meeting of shareholders.

| ||

| Thomas F. Karam Chairman and Chief Executive Officer |

Notice of Annual Meeting of Shareholders |

WHEN: The annual meeting of shareholders of Equitrans Midstream Corporation (the Company or Equitrans Midstream) will be held on Tuesday, April 27, 2021, at 9:00 a.m. (Eastern Time) virtually via live webcast at www.virtualshareholdermeeting.com/ETRN2021.

RECORD DATE: Our Board of Directors has established the close of business on February 19, 2021 as the record date for determining shareholders entitled to receive notice of, and to vote at, the annual meeting and any adjournment or postponement of the meeting.

ITEMS OF BUSINESS: The following matters will be voted on at the meeting:

VOTING: Please consider the issues presented in the attached proxy statement and vote your shares as soon as possible by following the voting instructions included in the proxy statement.

PARTICIPATING IN THE MEETING: Due to the ongoing public health considerations associated with the coronavirus disease 2019 (COVID-19), we will be holding our 2021 annual meeting of shareholders solely via webcast. You will be able to participate in the meeting online, vote your shares electronically and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/ETRN2021. To participate in the meeting, you will need the 16-digit control number on your notice of Internet availability of proxy materials, your voting instruction form or your proxy card. If you plan to participate in the meeting, please follow the instructions under "Additional Information — Participating in the Annual Meeting" on page 62 of the proxy statement.

On behalf of the Board of Directors,

![]()

Tobin M. Nelson |

Deputy General Counsel & Corporate Secretary

March 8, 2021

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Shareholders to Be Held April 27, 2021:

This notice and proxy statement and our annual report on Form 10-K for the year ended

December 31, 2020 are also available online at http://www.proxyvote.com.

| | We commenced providing our proxy materials, or a notice of Internet availability providing access to such materials, on or about March 15, 2021. | |

TABLE OF CONTENTS | ||

Proxy Statement Summary | | i |

| | | |

Item No. 1 – Election of Directors | | 1 |

| | | |

Director Nominees | | 3 |

Corporate Governance and Board Matters | | 7 |

| | | |

Board Meetings and Committees | | 7 |

Compensation Process | | 10 |

Board Leadership Structure | | 12 |

Board's Role in Risk Oversight | | 13 |

Director Nominations | | 14 |

Contacting the Board | | 16 |

Governance Principles | | 16 |

Independence and Related Person Transactions | | 18 |

Compensation Committee Interlocks and Insider Participation | | 20 |

Directors' Compensation | | 21 |

| | | |

Equity-Based Compensation | | 21 |

Deferred Compensation | | 21 |

Stock Ownership Guidelines | | 22 |

Other | | 22 |

2020 Directors' Compensation Table | | 22 |

Equity Ownership | | 23 |

| | | |

Stock Ownership of Significant Shareholders | | 23 |

Equity Ownership of Directors and Executive Officers | | 24 |

Delinquent Section 16(a) Reports | | 25 |

Executive Compensation Information | | 26 |

| | | |

Compensation Discussion and Analysis | | 26 |

| | | |

Our 2020 Named Executive Officers | | 26 |

Executive Summary | | 27 |

Compensation Philosophy and Practices | | 28 |

How We Determine Executive Compensation | | 30 |

2020 Compensation Program Elements | | 32 |

Other Considerations Important to Our Compensation Program | | 37 |

Report of the Management Development and Compensation Committee | | 38 |

Executive Compensation Tables | | 38 |

| | | |

Summary Compensation Table | | 39 |

2020 Grants of Plan-Based Awards Table | | 40 |

Narrative Disclosure to Summary Compensation Table and 2020 Grants of Plan-Based Awards Table | | 41 |

Outstanding Equity Awards at Fiscal Year-End | | 42 |

Option Exercises and Stock Vested | | 44 |

Potential Payments Upon Termination or Change of Control | | 44 |

Pay Ratio Disclosure | | 50 |

| | | |

Employee, Officer and Director Hedging | | 51 |

| | | |

Item No. 2 – Advisory Vote on the Compensation of the Company's Named Executive Officers for 2020 (Say-On-Pay) | | 52 |

| | | |

Item No. 3 – Approval of Amendments to Equitrans Midstream's Articles of Incorporation and Bylaws to Remove the Supermajority Voting Requirements | | 53 |

| | | |

Report of the Audit Committee | | 54 |

| | | |

Item No. 4 – Ratification of Appointment of Independent Registered Public Accounting Firm | | 56 |

| | | |

Securities Authorized for Issuance Under Equity Compensation Plans | | 58 |

| | | |

Equitrans Midstream Corporation Directors' Deferred Compensation Plan | | 58 |

Additional Information | | 59 |

| | | |

Proposals, Board Recommendations, Vote Required, and Broker Non-Votes | | 59 |

Corporate Secretary Contact Information | | 59 |

Notice of Internet Availability of Proxy Materials | | 60 |

Voting Instructions | | 60 |

Participating in the Annual Meeting | | 62 |

Other Matters | | 63 |

Appendices | | A-1 |

| | | |

Appendix A – Related Person Transactions with EQT | | A-1 |

Appendix B – Non-GAAP Financial Information | | B-1 |

Appendix C – Proposed Amendments to Amended and Restated Articles of Incorporation of Equitrans Midstream Corporation to Remove the Supermajority Voting Requirements | | C-1 |

Appendix D – Proposed Amendments to Second Amended and Restated Bylaws of Equitrans Midstream Corporation to Remove the Supermajority Voting Requirements | | D-1 |

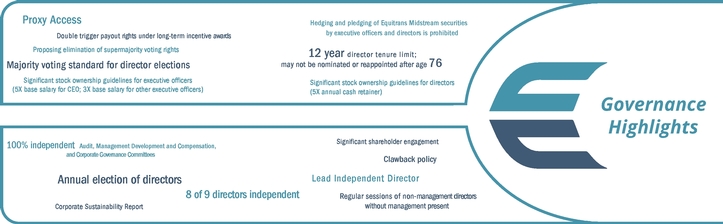

| PROXY STATEMENT SUMMARY OUR COMPANY Equitrans Midstream Corporation is one of the largest natural gas gatherers in the United States, with a premier asset footprint in the Appalachian Basin. Our Annual Report on Form 10-K for the year ended December 31, 2020 describes our company and the assets and liabilities that comprise our business. WE EXECUTED ON THE FINAL STEP OF OUR SIMPLIFICATION STRATEGY | | This summary highlights information about Equitrans Midstream Corporation and the upcoming 2021 annual meeting of shareholders. This summary does not contain all the information you should consider. You should read the entire proxy statement before you vote. We sometimes refer to Equitrans Midstream Corporation in this proxy summary and proxy statement as Equitrans Midstream, the Company, we, or us. |

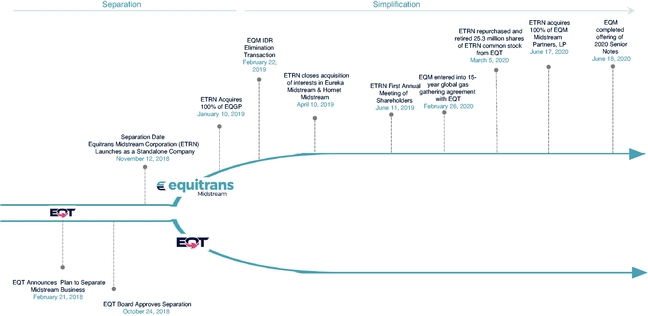

In June 2020, we executed on the final step of our simplification strategy when we acquired all of the outstanding public common units of EQM Midstream Partners, LP (EQM), our former publicly traded master limited partnership, in a share-for-unit transaction in which each outstanding EQM common unit was exchanged for 2.44 shares of Company common stock (the EQM Merger). In connection with the EQM Merger, EQM redeemed $600 million aggregate principal amount of EQM's outstanding Series A Perpetual Convertible Preferred Units (EQM Series A Preferred Units), and the Company issued newly created Equitrans Midstream preferred stock (Series A Preferred Shares) for the remaining portion of the outstanding EQM Series A Preferred Units. Contemporaneously with the announcement of the EQM Merger in February 2020, the Company also announced (i) a new 15-year global gas gathering agreement with EQT Corporation (EQT), the largest natural gas producer in the United States, based on average daily sales volumes, and the Company's largest customer, providing for 3.0 Bcf per day of initial minimum volume commitments (MVCs) with gradual step-ups to 4.0 Bcf per day following the full in-service date of the Mountain Valley Pipeline (MVP), as well as the dedication of a substantial majority of EQT's core acreage in the prolific Marcellus Shale play in Pennsylvania and West Virginia (the EQT Global GGA), and (ii) two share purchase agreements with EQT pursuant to which the Company repurchased and retired 25,299,752 shares of its common stock, which at the time represented approximately 10% of the Company's outstanding common stock. A graphical depiction of the Company's key strategic transactions since its separation from EQT in November 2018 that culminated in the EQM Merger and a single, pure-play midstream, public corporation is below:

Equitrans Midstream Corporation - 2021 Proxy Statement i

ANNUAL MEETING |

| Time and Date: | 9:00 a.m. (Eastern Time) on Tuesday, April 27, 2021 | ||

Place: | Online at www.virtualshareholdermeeting.com/ETRN2021 | ||

Record Date: | February 19, 2021 | ||

Participation: | You are entitled to participate in the virtual annual meeting if you were an Equitrans Midstream shareholder as of the close of business on the record date. See "Additional Information — Participating in the Annual Meeting" on page 62 of this proxy statement for additional information and instructions. |

VIRTUAL ANNUAL MEETING |

Due to the ongoing public health considerations associated with COVID-19, and because the health, safety and well-being of our employees and shareholders is of utmost importance to us, we will be holding our 2021 annual meeting of shareholders solely via webcast. We remain sensitive to concerns regarding virtual meetings generally from investor advisory groups and other shareholder rights advocates that have voiced concerns that virtual meetings may diminish shareholder voice or reduce accountability. Accordingly, we have designed the procedures for our virtual meeting format to enhance, rather than constrain, shareholder access, participation and communication, allowing a shareholder to participate fully and equally from any location at no cost to the shareholder. For example, the online format allows shareholders to communicate with us during the meeting so they can ask appropriate questions of our Board of Directors or management in accordance with the rules of conduct for the meeting and allow shareholders to vote electronically. See "Participating in the Annual Meeting" for additional information.

MATTERS TO BE VOTED UPON |

| | Board Voting Recommendation | Page for More Information | |||

|---|---|---|---|---|---|

| | | | | | |

Item No. 1: Election of nine directors, each for a one-year term expiring at the 2022 annual meeting of shareholders | FOR EACH NOMINEE | 1 | |||

| | | | | | |

Item No. 2: Approval, on an advisory basis, of the compensation of Equitrans Midstream's named executive officers for 2020 (Say-on-Pay) | FOR | 52 | |||

| | | | | | |

Item No. 3: Approval of Amendments to Equitrans Midstream's Articles of Incorporation and Bylaws to Remove the Supermajority Voting Requirements | FOR | 53 | |||

| | | | | | |

Item No. 4: Ratification of the appointment of Ernst & Young LLP as Equitrans Midstream's independent registered public accounting firm for 2021 | FOR | 56 | |||

| | | | | | |

ii Equitrans Midstream Corporation - 2021 Proxy Statement

BOARD AND BOARD COMMITTEES |

| | | | | Equitrans Midstream Board Committee Membership | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name, Principal Occupation & Current Other Public Company Board Service | | Director Since | | ||||||||||||

| Age | Independent | AC | CGC | MDCC | HSSE | ||||||||||

| | | | | | | | | | | | | | | | |

| Vicky A. Bailey | 68 | 2018 | |||||||||||||

| President, Anderson Stratton International, LLC & Vice President, BHMM Energy Services, LLC | Chair | ||||||||||||||

Current Other Public Company Boards: Cheniere Energy, Inc., PNM Resources, Inc. | |||||||||||||||

| | | | | | | | | | | | | | | | |

| Sarah M. Barpoulis | 55 | 2020 | |||||||||||||

| President, Interim Energy Solutions, LLC | |||||||||||||||

Current Other Public Company Boards: South Jersey Industries, Inc. | |||||||||||||||

| | | | | | | | | | | | | | | | |

| Kenneth M. Burke | 71 | 2018 | |||||||||||||

| Retired Partner, Ernst & Young LLP | Chair | ||||||||||||||

Current Other Public Company Boards: None | |||||||||||||||

| | | | | | | | | | | | | | | | |

| Patricia K. Collawn | 62 | 2020 | |||||||||||||

| Chairman, President and Chief Executive Officer, PNM Resources, Inc. | |||||||||||||||

Current Other Public Company Boards: PNM Resources, Inc., CTS Corporation* | |||||||||||||||

| | | | | | | | | | | | | | | | |

| Margaret K. Dorman | 57 | 2018 | |||||||||||||

| Retired Executive Vice President, Chief Financial Officer and Treasurer, Smith International, Inc. | Chair | ||||||||||||||

Current Other Public Company Boards: Range Resources Corporation | |||||||||||||||

| | | | | | | | | | | | | | | | |

| Thomas F. Karam (Chairman) | 62 | 2018 | |||||||||||||

| Chairman and Chief Executive Officer, Equitrans Midstream Corporation | |||||||||||||||

Current Other Public Company Boards: None | |||||||||||||||

| | | | | | | | | | | | | | | | |

| D. Mark Leland | 59 | 2020 | |||||||||||||

| Retired Interim Chief Executive Officer, Deltic Timber Corporation and former Executive Vice President and Chief Financial Officer, El Paso Corporation | |||||||||||||||

Current Other Public Company Boards: PotlatchDeltic Corporation, Altus Midstream Company | |||||||||||||||

| | | | | | | | | | | | | | | | |

| Norman J. Szydlowski | 69 | 2018 | |||||||||||||

| Retired President and Chief Executive Officer, SemGroup Corporation | Chair | ||||||||||||||

Current Other Public Company Boards: None | |||||||||||||||

| | | | | | | | | | | | | | | | |

| Robert F. Vagt (Lead Independent Director) | 73 | 2018 | |||||||||||||

| Retired President, The Heinz Endowments | |||||||||||||||

Current Other Public Company Boards: Kinder Morgan, Inc. | |||||||||||||||

| | | | | | | | | | | | | | | | |

| AC | Audit Committee | MDCC | Management Development and Compensation Committee | ||||

| CGC | Corporate Governance Committee | HSSE | Health, Safety, Security and Environmental Committee |

Equitrans Midstream Corporation - 2021 Proxy Statement iii

GOVERNANCE HIGHLIGHTS |

BUSINESS HIGHLIGHTS |

While the COVID-19 outbreak has significantly impacted the manner in which our employees and contractors perform their job functions, the outbreak has had, and continues to have, a minimal impact on our overall operations. As a midstream energy company, during applicable state-issued stay-at-home orders, we have been recognized as an essential business under various regulations related to the COVID-19 outbreak and continued to operate as permitted under these regulations. We have proactively undertaken a number of companywide measures intended to promote the safety of field and office-based employees and contractors. These measures include, among other things, establishing an Infectious Disease Response Team, instituting enhanced self-protection and office sanitation measures, eliminating non-essential business travel, implementing a mandatory work-from-home protocol for a substantial majority of our employees through at least June 1, 2021, instituting face covering protocols, providing certain medical benefit enhancements, practicing social distancing in the field where possible, sharing our infectious disease response plan with suppliers and contractors, and timely communicating updates to employees and other relevant parties. In addition, we have implemented additional mitigation efforts in connection with the remobilization of certain field level employees and contractors. Our Infectious Disease Response Team continues to monitor and assist in implementing mitigation efforts in respect of potential areas of risk for us and our stakeholders. Additionally, we have provided support to local communities through corporate giving and the Equitrans Midstream Foundation. We have been able to maintain a consistent level of effectiveness through the measures taken.

iv Equitrans Midstream Corporation - 2021 Proxy Statement

COMPENSATION HIGHLIGHTS |

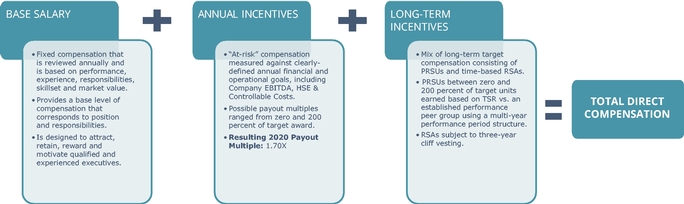

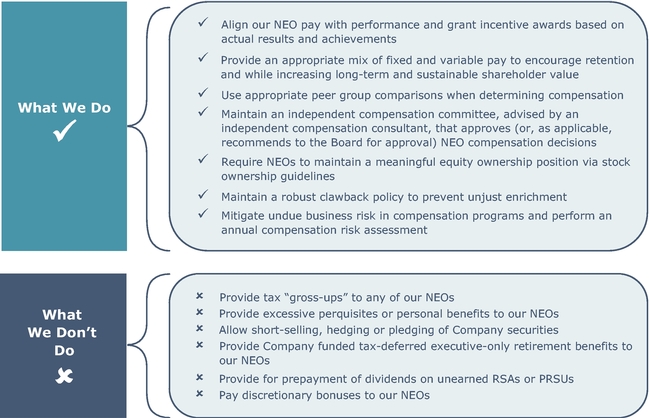

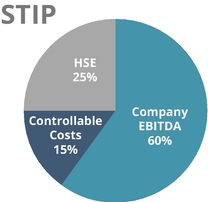

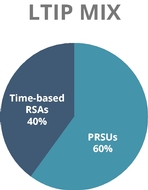

The Management Development and Compensation Committee (Compensation Committee) of the Company's Board of Directors adopted a compensation philosophy and developed programs and practices that seek to (i) align total direct compensation for our named executive officers (NEOs) using market comparables and other relevant factors; and (ii) deliver transparency and fairness to shareholders, employees and other stakeholders while encouraging sound business strategy and execution that leads to long-term and sustainable shareholder value. At our 2020 annual meeting, our say-on-pay proposal received support from over 97% of our shares voted, leading the Compensation Committee to believe our compensation programs and practices have strong shareholder support. The primary components of our 2020 compensation program were:

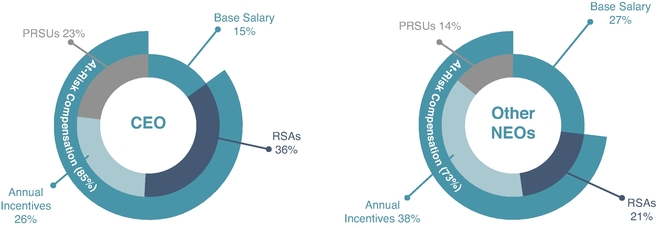

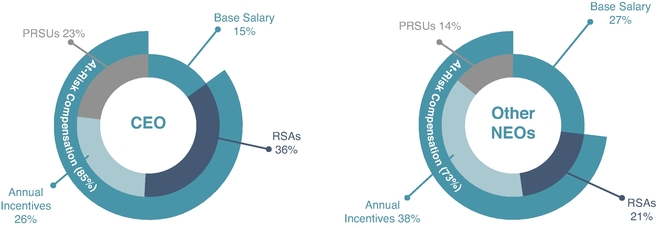

The compensation program is designed to provide an appropriate mix of fixed and variable pay to encourage retention and corporate sustainability to increase long-term and sustainable shareholder value. The program is weighted towards variable pay that requires the Company to achieve well defined performance metrics in order for NEOs to realize performance-based annual and long-term incentives. The charts below reflect the fixed and at-risk components of the 2020 compensation for (i) Mr. Karam, our Chief Executive Officer, and (ii) our other NEOs. The amounts for each component of total direct compensation (TDC) set forth in the charts below were calculated in accordance with Securities and Exchange Commission (SEC) rules. TDC, which is not a substitute for the total compensation as reported in the Summary Compensation Table on page 39 of this proxy statement, omits certain other compensation (e.g., 401(k) contributions and perquisites) that is reflected in the Summary Compensation Table. For additional information, including information regarding how total compensation is calculated under SEC rules, see the footnotes accompanying the Summary Compensation Table.

Equitrans Midstream Corporation - 2021 Proxy Statement v

IMPORTANT DATES FOR 2022 ANNUAL MEETING OF SHAREHOLDERS |

| Shareholder proposals submitted for inclusion in Equitrans Midstream's 2022 proxy statement under SEC rules must be submitted in writing and received by Equitrans Midstream's Corporate Secretary on or before November 15, 2021. |

| |

| Under Equitrans Midstream's Second Amended and Restated Bylaws (the Bylaws), if a shareholder would like to present a matter not included in Equitrans Midstream's proxy statement in person at the 2022 annual meeting of shareholders, including nominations for director candidates, advance notice must be submitted in writing and received by Equitrans Midstream's Corporate Secretary no earlier than the close of business on December 28, 2021, and no later than the close of business on January 27, 2022. |

| |

| Under Equitrans Midstream's proxy access Bylaws provision, a shareholder, or group of twenty or fewer shareholders, owning continuously for at least three years, shares of Equitrans Midstream representing an aggregate of at least 3% of the voting power entitled to vote in the election of directors, may nominate and include in Equitrans Midstream's proxy statement director nominees constituting the greater of (i) two and (ii) 20% of the Board of Directors of Equitrans Midstream provided that such nominations are submitted in writing and received by our Corporate Secretary no earlier than the close of business on October 16, 2021 (the 150th day prior to the first anniversary of the date that the Company mailed its proxy statement for the prior annual meeting) and no later than the close of business on November 15, 2021 (the 120th day prior to the first anniversary of the date that the Company mailed its proxy statement for the prior annual meeting). |

| |

For additional information, see "Additional Information – Shareholder Proposals and Director Nominations" on page 63 of this proxy statement. |

vi Equitrans Midstream Corporation - 2021 Proxy Statement

ITEM NO. 1 – ELECTION OF DIRECTORS |

The Board of Directors recommends a vote FOR each nominee for the Board of Directors. |

Our Board of Directors, sometimes referred to in this proxy statement as the Board or our Board, is presenting nine nominees for election as directors at our annual meeting. All nominees currently serve on our Board of Directors and their current terms will expire at the 2021 annual meeting. Mses. Vicky A. Bailey, Sarah M. Barpoulis, Patricia K. Collawn, and Margaret K. Dorman, and Messrs. Kenneth M. Burke, Thomas F. Karam, D. Mark Leland, Norman J. Szydlowski, and Robert F. Vagt, have been nominated to serve for a term of one year to expire at the 2022 annual meeting, or until their earlier removal or resignation or a successor is duly elected and qualified. Each nominee consents to being named in this proxy statement and to serve if elected. The Board has no reason to believe that any nominee will be unavailable or unable to serve. If any nominee is unable to stand for election for any reason, then the shares represented at our annual meeting will be voted by the persons named as proxies for substitute nominees proposed by the Board, unless the Board decides to reduce its size.

The Board, following the recommendation of the Corporate Governance Committee, selected our nine nominees based on a review of the attributes discussed on page 14 under "Corporate Governance and Board Matters – Director Nominations." Our Board believes that the nominees, individually and as a whole, possess qualifications consistent with our desired attributes and will provide management with strong independent oversight as we implement our strategic objectives. The following chart provides an overview of the attributes represented on our Board of Directors, in addition to each director's competencies included in the director profiles on the following pages.

Each of our director nominees brings a unique skillset to the Board of Directors. Notably, all nine of our director nominees:

Equitrans Midstream Corporation - 2021 Proxy Statement 1

Our director nominees are also experienced in the following areas:

Each nominee must be elected by a majority of the votes cast FOR that director's election, and votes may not be cumulated. The persons named as proxies will vote FOR the nominees named, unless you vote against, or abstain from voting for or against, one or more of them.

In addition, under our Bylaws, each nominee has submitted an irrevocable conditional resignation to be effective if the nominee receives a greater number of votes against than votes FOR his or her election in an uncontested election. If this occurs, the Board will decide whether to accept the tendered resignation no later than 90 days after certification of the election. The Board's determination shall be made without the participation of any nominee whose resignation is under consideration with respect to the election. The Board's explanation of its decision will be promptly disclosed on a Form 8-K furnished to the SEC.

2 Equitrans Midstream Corporation - 2021 Proxy Statement

Director Nominees |

| | | | | |

| Vicky A. Bailey | | Age 68 | | Director since November 2018 |

| | | | | |

Ms. Bailey has served as President, Anderson Stratton International, LLC (strategic consulting and government relations), since November 2005; and Vice President, BHMM Energy Services, LLC (utility and facilities management services), since January 2006. Ms. Bailey has been a director of Cheniere Energy, Inc. (an energy company primarily engaged in liquefied natural gas related businesses) since March 2006 where she serves as a member of the Audit and Governance and Nominating Committees and a director of PNM Resources, Inc. (an investor-owned holding company with two regulated utilities providing electricity and electric services in New Mexico and Texas) (PNM) since January 2019 where she serves as a member of the Audit and Ethics Committee and Chair of the Nominating and Governance Committee. She was a director of EQT Corporation from June 2004 until November 12, 2018, when EQT spun out Equitrans Midstream into a separate publicly traded company (the Separation), and of Cleco Corporation (an energy services company with regulated utility and wholesale energy businesses) from June 2013 through March 2016.

Qualifications: Ms. Bailey has substantial regulatory and senior management experience in the energy industry, having previously served as a commissioner of the Federal Energy Regulatory Commission, President of PSI Energy, Inc. (a regulated utility) and commissioner of the Indiana Utility Regulatory Commission. These experiences enable her to provide valuable insights into issues facing the Company's regulated transmission business, particularly with respect to interacting with regulatory agencies. In addition, Ms. Bailey provides leadership to the Board with respect to energy policy issues, owing to her previous experience as Assistant Secretary for the Office of Policy and International Affairs at the Department of Energy. Ms. Bailey also draws upon public company board experience in supporting the Company's strategic efforts.

Ms. Bailey is Chair of the Corporate Governance Committee and a member of the Health, Safety, Security and Environmental (HSSE) Committee.

| | | | | |

| | | |||

| | | | | |

| Sarah M. Barpoulis | | Age 55 | | Director since February 2020 |

| | | | | |

Ms. Barpoulis is the founder and President of Interim Energy Solutions, LLC (an advisory service firm providing asset management and risk management consulting, and litigation support services to the energy sector) since 2003. She has served as a director of South Jersey Industries, Inc. (a publicly traded energy services holding company) since April 2012 where she serves as a member of the Audit Committee (serving as Chair since 2017), the Executive Committee, the Strategy and Finance Committee and the Compensation Committee. She previously served as a director of SemGroup Corporation (a publicly traded provider of gathering, transmission, storage, distribution, marketing and other midstream services) (SemGroup) from October 2009 through the sale of SemGroup to Energy Transfer, LP in December 2019.

Qualifications:Ms. Barpoulis brings nearly 30 years of experience in the energy industry, significant executive-level leadership experience as well as valuable risk management, business planning and commercial expertise through her work as an energy advisor and consultant through Interim Energy Solutions, LLC and her varied roles of increasing responsibility over more than a decade with PG&E National Energy Group, a company that, among other things, developed, built, owned and operated electric generating and natural gas pipeline facilities. Ms. Barpoulis also brings significant public company board experience from her service on the boards of directors of a number of public companies. Ms. Barpoulis is a National Association of Corporate Directors Board Leadership Fellow, demonstrating her commitment to the highest standards of board leadership.

Ms. Barpoulis is a member of the Corporate Governance Committee and the HSSE Committee.

| | | | | |

| | |

Equitrans Midstream Corporation - 2021 Proxy Statement 3

| | | | | |

| Kenneth M. Burke | | Age 71 | | Director since November 2018 |

| | | | | |

Mr. Burke was a Partner at Ernst & Young LLP (EY) (a Big Four accounting firm) from October 1982 through June 2004. Mr. Burke served on the board of directors of Nexeo Solutions, Inc. (a publicly traded global chemical distributor) from November 2011 until its acquisition in March 2019. Mr. Burke also was appointed to the boards of directors of the general partners of EQM and EQGP Holdings, LP (EQGP), both of which were publicly traded master limited partnerships controlled by the Company, in September 2018, serving in such capacities until the Company's acquisitions of the outstanding public common units of each of EQM and EQGP in June 2020 and January 2019, respectively. Mr. Burke also served on and chaired the Audit Committees of the boards of directors of the general partners of EQM and EQGP. Mr. Burke served as a director of EQT Corporation from January 2012 until the Separation.

Qualifications: Mr. Burke brings over three decades of experience focused on the energy industry, primarily oil and gas. Mr. Burke retired from EY in 2004, where he held a number of leadership positions, including National Energy Industry Director and Partner-in-Charge of the Houston Energy Services Group. He also co-authored the book "Oil and Gas Limited Partnerships: Accounting, Reporting and Taxation." During his years at EY, Mr. Burke served as audit partner for numerous companies in the oil and gas industry. Mr. Burke also has substantial experience as a director of both public and private companies where he has served on and chaired a number of committees.

Mr. Burke is Chair of the Audit Committee and a member of the Corporate Governance Committee.

| | | | | |

| | | |||

| | | | | |

| Patricia K. Collawn | | Age 62 | | Director since April 2020 |

| | | | | |

Ms. Collawn has served as President and Chief Executive Officer of PNM since 2010. She has also served as a director of PNM since 2010 and was appointed Chairman of its board of directors in 2012. Ms. Collawn joined PNM in 2007 and served as President and Chief Operating Officer and President, Utilities of PNM prior to her promotion to President and Chief Executive Officer in 2010. In addition to serving on the board of directors of PNM, Ms. Collawn has served as an independent director of CTS Corporation (a publicly traded designer and manufacturer of sensors, actuators and electronic components for various industries) since 2003, most recently serving as the Chair of the Compensation Committee and a member of the Nominating and Governance Committee. Ms. Collawn has indicated that she will not stand for re-election to the board of directors of CTS Corporation at its 2021 annual meeting of shareholders in the second quarter of 2021. Additionally, Ms. Collawn will step down as Chairman, President and Chief Executive Officer of PNM upon the closing of PNM's merger combination with Avangrid, Inc., which PNM expects to close in the second half of 2021.

Qualifications: As a senior executive in the power utilities sector for more than 25 years, Ms. Collawn has an in-depth understanding of the complex regulatory structure of the utility industry, as well as substantial operations experience, having also served as President and Chief Executive Officer of Public Service Company of Colorado, an Xcel Energy, Inc. subsidiary. Additionally, she previously served as chairman of the Electric Power Research Institute (an independent, non-profit center for public interest energy and environmental research, including sustainability and carbon reduction matters), as well as the first female chairman of the board of directors of the Edison Electric Institute (a national association of investor-owned electric companies). Along with her executive leadership experience and a focus on corporate governance, cybersecurity, and environmental and sustainability matters, Ms. Collawn brings both commercial and operational expertise through her work in the public utility sector.

Ms. Collawn is a member of the Compensation Committee and the HSSE Committee.

| | | | | |

| | |

4 Equitrans Midstream Corporation - 2021 Proxy Statement

| | | | | |

| Margaret K. Dorman | | Age 57 | | Director since November 2018 |

| | | | | |

Ms. Dorman served as Chief Financial Officer and Treasurer of Smith International, Inc. (a publicly traded supplier of oil and gas products and services) (now part of Schlumberger Limited), between May 1999 and October 2009. Ms. Dorman has served as a director and member of the Audit Committee and Governance and Nominating Committee of Range Resources Corporation (a publicly traded petroleum and natural gas exploration and production company) since July 2019. Ms. Dorman has also been a director of Rubicon Oilfield International (a privately-held provider of oilfield products and technologies) since August 2018, where she serves as Chair of the Audit Committee and a member of the Compensation Committee. She also served as a director of EQT Corporation from January 2012 until the Separation.

Qualifications: Ms. Dorman brings to Equitrans Midstream a wealth of financial expertise and experience in the energy industry, having served in numerous financial positions with Smith International, Inc., including as the Chief Financial Officer for more than a decade, during a period of expansive growth. Previously, Ms. Dorman held management positions with Landmark Graphics, prior to its acquisition by Halliburton Corporation, and EY. She has experience directing financial accounting functions, building banking relationships, structuring debt and equity financings, integrating acquisitions and interacting with shareholders as the lead investor relations executive. Ms. Dorman also has other board and audit committee experience, having served as a director of EQT as well as Hanover Compressor Company (a full service natural gas compression business) (now part of Exterran Holdings, Inc.) from February 2004 through the date of the Exterran Holdings merger in August 2007.

Ms. Dorman is Chair of the Compensation Committee and a member of the Corporate Governance Committee.

| | | | | |

| | | |||

| | | | | |

| Thomas F. Karam | | Age 62 | | Director since November 2018 |

| | | | | |

Mr. Karam was appointed Chairman of the Board of Directors and Chief Executive Officer of Equitrans Midstream in July 2019. Prior to that, Mr. Karam served as President and Chief Executive Officer of Equitrans Midstream since September 2018 and a member of the Board of Equitrans Midstream since November 2018. Prior to Equitrans Midstream, he served as Senior Vice President, EQT Corporation and President, Midstream from August 2018 until the Separation in November 2018. Mr. Karam also served as the Chairman and Chief Executive Officer of EQM's general partner from July 2019 until the closing of the EQM Merger in June 2020, and previously served as Chairman, President and Chief Executive Officer, from October 2018 to July 2019, and as President, Chief Executive Officer and director, from August 2018 to October 2018. In addition, Mr. Karam served as Chairman, President and Chief Executive Officer of EQGP's general partner from October 2018 through the closing of the Company's acquisition of the outstanding public common units of EQGP in January 2019, as well as President, Chief Executive Officer and director from August 2018 to October 2018. Mr. Karam served on EQT's board of directors from November 2017 until the Separation. Mr. Karam was the founder and served as Chairman of Karbon Partners, LLC, which invests in, owns, constructs and operates midstream energy assets, from April 2017 to August 2018. Mr. Karam was the founder and previously served as Chairman and Chief Executive Officer of PennTex Midstream Partners, LP, a publicly traded master limited partnership with operations in North Louisiana and the Permian Basin (PennTex), from 2014 until the sale of its general partner to Energy Transfer Partners in 2016.

Qualifications: Mr. Karam has been a senior executive and entrepreneur in the midstream energy sector for more than 25 years. Preceding PennTex, he was the founder, Chairman and Chief Executive Officer of Laser Midstream Partners, LLC (Laser), one of the first independent natural gas gathering systems in the northeast Marcellus Shale, from 2010 until 2012 when it was acquired by Williams Partners. Prior to Laser, Mr. Karam was the President, Chief Operating Officer and director of Southern Union Company, where he led its successful transformation from a large local distribution company to one of the largest pipeline companies in the United States at the time. Prior to Southern Union Company, Mr. Karam was the President and Chief Executive Officer of Pennsylvania Enterprises and PG Energy, a natural gas utility in central and northeastern Pennsylvania, until its acquisition by Southern Union Company. He began his professional career in investment banking with Legg Mason Inc. and Thomson McKinnon.

| | | | | |

| | |

Equitrans Midstream Corporation - 2021 Proxy Statement 5

| | | | | |

| D. Mark Leland | | Age 59 | | Director since January 2020 |

| | | | | |

Mr. Leland served as Interim Chief Executive Officer of Deltic Timber Corporation from October 2016 to March 2017, prior to the company's merger with Potlatch Corporation to form PotlatchDeltic Corporation (a publicly traded timberland real estate investment trust) (PotlatchDeltic) in February 2018. Mr. Leland has served as a director of PotlatchDeltic since February 2018 where he serves as a member of its Audit Committee and its Executive Compensation and Personnel Policies Committee. Mr. Leland has also served as a director of Altus Midstream Company (and its predecessor) (a publicly traded midstream company providing gathering processing and transportation services in the Permian Basin) since April 2016 where he serves as the Chair of its Conflicts Committee and a member of its Audit Committee. Previously, he served as a director and Chair of the Audit Committee of Deltic Timber Corporation from June 2016 to February 2018 and the general partner of Rice Midstream Partners LP (RMP) from December 2014 until its merger with EQM in July 2018. Mr. Leland served on the board of directors of the general partner of Oiltanking Partners, L.P. (a publicly traded company providing terminaling, storage and transportation of crude oil, refined petroleum products and liquefied petroleum gas) from June 2012 to February 2015 and on the board of directors of KiOR, Inc. (a publicly traded renewables fuel company) from June 2013 to March 2015.

Qualifications: Mr. Leland brings extensive operational and financial experience in the midstream energy industry, having served as President of El Paso Corporation's (El Paso) midstream business unit from October 2009 to May 2012, and as director of El Paso Pipeline Partners, L.P. from its formation in 2007 to May 2012. Among other senior-level roles at El Paso, Mr. Leland also previously served as Executive Vice President and Chief Financial Officer of El Paso from August 2005 to October 2009. This experience as well as experience on the boards of numerous publicly traded and private energy companies provide significant contributions to the Board.

Mr. Leland is a member of the Audit Committee and the Compensation Committee.

| | | | | |

| | | |||

| | | | | |

| Norman J. Szydlowski | | Age 69 | | Director since November 2018 |

| | | | | |

Mr. Szydlowski served as President and Chief Executive Officer of SemGroup from November 2009 through June 2014, and director of SemGroup from November 2009 through April 2014. Mr. Szydlowski served as a director of EQT from November 2017 until the Separation and as a director of the general partner of 8point3 Energy Partners, LP (a publicly traded joint venture formed to own and operate solar generation assets) from June 2015 until its acquisition by Capital Dynamics, Inc. in June 2018. He also served as a director of the general partner of JP Energy Partners LP (a publicly traded oil and natural gas company) from July 2014 through March 2017, a director of Transocean Partners, LLC (a publicly traded offshore drilling contractor) from November 2014 through December 2016, and a director of the general partner of NGL Energy Partners LP (a publicly traded company specializing in transportation, storage, blending and marketing of crude oils, natural gas, refined products, renewables and water solutions) from November 2011 through April 2014.

Qualifications: Mr. Szydlowski's experience at SemGroup and before that as Chief Executive Officer of Colonial Pipeline Company (a refined pipeline system) and elsewhere provides him with significant executive and operational midstream experience. In particular, Mr. Szydlowski has a thorough understanding of the midstream business and midstream customers.

Mr. Szydlowski is Chair of the HSSE Committee and a member of the Compensation Committee.

| | | | | |

| | |

6 Equitrans Midstream Corporation - 2021 Proxy Statement

| | | | | |

| Robert F. Vagt | | Age 73 | | Director since November 2018 |

| | | | | |

Mr. Vagt currently serves as the Lead Independent Director of Equitrans Midstream. Mr. Vagt served as President of Davidson College (an independent liberal arts college) from July 1997 through August 2007, and served as President of The Heinz Endowments (a private philanthropic foundation) from January 2008 through January 2014. Mr. Vagt served as a director of EQT from November 2017 until the Separation. Mr. Vagt was a director of Rice Energy Inc. (Rice Energy), serving as that board's independent Chair, Chair of its Health, Safety and Environmental Committee, and a member of the Audit and Nominating and Governance Committees, from January 2014 through EQT's acquisition of Rice Energy in November 2017. From January 2014 to July 2018, Mr. Vagt also served on the board of directors of the general partner of RMP (acquired by EQM in July 2018), serving as board Chair from December 2014 through November 2017. Mr. Vagt has served as a director of Kinder Morgan, Inc. (a publicly traded energy infrastructure company) since May 2012, where he serves as a member of the Audit Committee and Chair of its Environmental, Health and Safety Committee.

Qualifications: Prior to his service to The Heinz Endowments and Davidson College, Mr. Vagt had significant executive and operational oil and gas industry experience, having served as President and Chief Operating Officer of Seagull Energy Corporation (an oil and gas exploration and production company) from 1996 to 1997, as President, Chairman and Chief Executive Officer of Global Natural Resources (a producer of oil and natural gas) from 1992 to 1996 and as President and Chief Operating Officer of Adobe Resources Corporation (an oil and natural gas production company) from 1989 to 1992. Mr. Vagt also served as a director of El Paso Corporation (a provider of natural gas and related energy products) (now part of Kinder Morgan, Inc.) from May 2005 to 2012, where he was a member of the Compensation and Health, Safety and Environmental Committees. Mr. Vagt's professional background, including operations and management experience in both the public and private sectors, makes him an important advisor and member of Equitrans Midstream's Board. In addition, Mr. Vagt provides the Board with diversity of perspective gained from service as the President of The Heinz Endowments, as well as from service as the President of Davidson College.

Mr. Vagt is a member of the Audit Committee.

| | | | | |

CORPORATE GOVERNANCE AND BOARD MATTERS |

Board Meetings and Committees |

The Board currently has four standing Committees: Audit, Management Development and Compensation, Corporate Governance, and Health, Safety, Security and Environmental. The Board may from time to time form new Committees, disband an existing Committee and delegate additional responsibilities to a Committee. Our Committees report on their activities to the Board on a routine basis and also make recommendations regarding matters to be approved by the Board. The responsibilities of the Committees are included in written charters, which are reviewed at least annually by the Committees and the Board. All charters may be viewed on the Company's website at www.equitransmidstream.com by clicking on "About" on the main page and then on "Governance."

The Company does not have a formal policy of requiring its directors to attend the annual meeting, but the Company encourages them to do so. All but one of our directors, who had a previous engagement, participated in the 2020 annual meeting.

In 2020, our Board held 18 meetings, with regular communication between meetings, and each of our directors serving on the Board during 2020 attended 100% of the aggregate meetings of our Board and the Committees on which he or she served. The following charts summarize each Committee's primary responsibilities, membership and number of meetings held in 2020.

Equitrans Midstream Corporation - 2021 Proxy Statement 7

Audit Committee |

Members Kenneth M. Burke (Chair) D. Mark Leland Robert F. Vagt | Meetings Held in 2020:10 |

Primary Responsibilities: The Audit Committee assists the Board by overseeing:

Independence: Each member of the Committee is independent under the Company's corporate governance guidelines and applicable New York Stock Exchange (NYSE) listing standards and SEC rules. Each member of the Committee is financially literate. The Board has determined that each of Messrs. Burke, Leland and Vagt qualify as an audit committee financial expert as defined under SEC rules. The designation as an audit committee financial expert does not impose any duties, obligations, or liabilities that are greater than those generally imposed upon a director who is a member of the Committee and the Board. As audit committee financial experts, Messrs. Burke, Leland and Vagt also have accounting or related financial management experience under applicable NYSE listing standards.

Management Development and Compensation Committee |

Members Margaret K. Dorman (Chair) Patricia K. Collawn D. Mark Leland Norman J. Szydlowski | Meetings Held in 2020:9 |

Primary Responsibilities: The Compensation Committee:

The Committee has the authority, in its sole discretion, to retain or obtain the advice of an independent compensation consultant, outside legal counsel or other personnel. It may also obtain advice and assistance from internal legal, accounting, human resources and other advisors. Pursuant to its Charter, the Committee may delegate authority and responsibilities to subcommittees as it deems proper provided that no subcommittee shall consist of less than two members.

Independence: Each member of the Committee meets the independence requirements of the NYSE or any other national securities exchange on which the securities of the Company are listed and applicable federal securities law, including the rules and regulations of the SEC.

8 Equitrans Midstream Corporation - 2021 Proxy Statement

Corporate Governance Committee |

Members Vicky A. Bailey (Chair) Sarah M. Barpoulis Kenneth M. Burke Margaret K. Dorman | Meetings Held in 2020:7 |

Primary Responsibilities: The Corporate Governance Committee is responsible for:

Independence: Each member of the Committee is independent under the Company's corporate governance guidelines and applicable NYSE listing standards.

Health, Safety, Security and Environmental Committee |

Members Norman J. Szydlowski (Chair) Vicky A. Bailey Sarah M. Barpoulis Patricia K. Collawn | Meetings Held in 2020:8 |

Primary Responsibilities: The HSSE Committee:

Equitrans Midstream Corporation - 2021 Proxy Statement 9

Compensation Process |

In discharging the Board's responsibilities relating to compensation of the Company's executive officers, the Compensation Committee recommends, and the Board approves, the target total direct compensation for NEOs by establishing base salaries and setting short-term (bonus) and long-term incentive targets. This process includes consideration of the items discussed in more detail in the section titled "Compensation Discussion and Analysis — Determination of Target Total Direct Compensation (TDC)" below. When appropriate, the Compensation Committee also provides certain limited perquisites and other benefits to executive officers and other key employees.

The Compensation Committee, with the approval of the Board, establishes the plan designs and performance metrics for all of the Company's short-term and long-term incentive programs. The Compensation Committee also sets target and maximum metrics and related payouts under the Company's programs for executive officers and reviews the appropriateness of these for all other Company personnel. After completion of the performance period, the Compensation Committee reviews actual performance in comparison to established metrics to determine the amount of short-term and long-term incentive awards earned for each executive officer and for other Company personnel in total.

The Compensation Committee has retained the services of Mercer (US) Inc. (Mercer) as its independent consultant to aid the Compensation Committee in performing its duties. Representatives of Mercer provided the Compensation Committee with market data and counsel regarding executive officer compensation programs and practices, discussed in more detail in the section titled "Compensation Discussion and Analysis" below. Representatives of Mercer do not make recommendations on, or approve, the amount of compensation for any executive officer. The Company has affirmatively determined that no conflict of interest has arisen in connection with the work of Mercer as compensation consultant for the Compensation Committee.

The Company's compensation process includes discussions among the members of the Compensation Committee, other independent directors of the Board, management and Mercer. The Compensation Committee always seeks approval of the Board with respect to the total direct compensation for each executive officer.

Certain executive officers may review information with the Compensation Committee during meetings and may present management's views or recommendations. The Compensation Committee evaluates these recommendations including, if desired, in consultation with its independent compensation consultant, and takes them into consideration when making the Compensation Committee's decisions and recommendations. When establishing total direct compensation for executive officers and reviewing actual performance against established metrics, the Compensation Committee considers the CEO's compensation recommendations. The CEO does not participate in Compensation Committee or Board deliberations about his compensation.

Beginning in 2019, the Compensation Committee delegated limited authority to Mr. Karam, in his capacity as a director of the Company, to issue special bonus payments and grant certain long-term incentive awards under the Equitrans Midstream Corporation 2018 Long-Term Incentive Plan (as amended, the ETRN LTIP). These awards must follow established guidelines (which were subsequently amended in the third quarter of 2020), are reviewed by the Compensation Committee on a quarterly basis, and include New Hire, CEO, Retention and Discretionary New Hire Awards.

The Compensation Committee has approved a pre-established basket to provide for off-cycle New Hire awards pursuant to the following guidelines:

10 Equitrans Midstream Corporation - 2021 Proxy Statement

The Compensation Committee has also approved a pre-established basket to provide for CEO Awards, Retention Awards, and Discretionary New Hire Awards to individuals other than executive officers and direct reports of the CEO pursuant to the following guidelines:

The Compensation Committee has not delegated its authority to award equity to any other executive officer.

We provide additional information regarding the Compensation Committee and the Company's policies and procedures regarding executive compensation below under "Compensation Discussion and Analysis."

Equitrans Midstream Corporation - 2021 Proxy Statement 11

Board Leadership Structure |

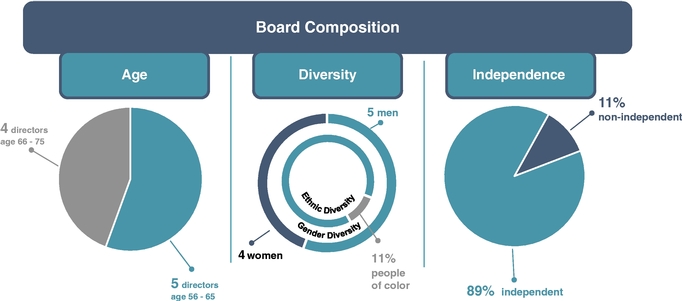

As described in the Company's corporate governance guidelines, the Board of Directors believes that the functions of the Chairman of the Board are distinct from those of the CEO but that both functions may be effectively performed by the same individual. From time to time, generally in connection with succession planning, the Board will consider whether the Chairman and the CEO should be separate, and if separate, whether the Chairman should be an outside director or an inside director. In July 2019, the Board concluded that combining the functions of Chairman and CEO was the most effective leadership structure for the Company and appointed Mr. Karam as the Chairman of the Board. The Board reaffirmed its conclusion in May 2020 and, based on a recommendation of the Corporate Governance Committee, reappointed Mr. Karam as Chairman of the Board for a term expiring at the Board's 2021 annual meeting. The Board believes the present structure provides the Company and the Board with strong leadership and appropriate independent oversight of management, with a strong Lead Independent Director in Mr. Vagt and a board structure that is 89% independent. In addition, a combined Chairman and CEO allows the Company to communicate its business, strategy and value to shareholders, investors, employees, other stakeholders, regulators and the public with a single voice.

Under the Company's corporate governance guidelines, when the Board does not have an independent Chairman, the Board must designate an independent director as the Lead Independent Director. The Lead Independent Director's exclusive duties are described in the box on this page.

A Lead Independent Director's term is generally for one year, but an individual may serve multiple consecutive terms as the Lead Independent Director if recommended by the Corporate Governance Committee and approved by the Board.

In May 2020, the Board, based on a recommendation from the Corporate Governance Committee, re-elected Mr. Vagt to serve as Lead Independent Director of the Board for a one-year term. Mr. Vagt has held this position since the Separation.

Our Lead Independent Director: |

12 Equitrans Midstream Corporation - 2021 Proxy Statement

Board's Role in Risk Oversight |

The Board

| | | |||

| Audit Committee ➢ Discusses the Company's process for assessing major risk exposures and the policies management has implemented to monitor and control such exposures, including the Company's financial risk exposures, including financial statement risk and such other risk exposures as may be delegated by the Board to the Committee for oversight, and the Company's risk management policies ➢ Reviews the integrity of the Company's financial statements ➢ Reviews the qualifications, independence and performance of the Company's registered public accountants ➢ Reviews the qualifications and performance of the Company's internal audit function | | | Corporate Governance Committee ➢ Addresses governance of the Company, including its director compensation structure, that is in full compliance with law, reflects good corporate governance, encourages flexible and dynamic management without undue burdens and effectively manages the risks of the business and operations of the Company ➢ Identifies board members of the highest possible caliber to provide insightful, intelligent, and effective guidance to management ➢ Reviews plans for management succession ➢ Reviews periodically and makes such recommendations regarding the Company's risks as may be delegated to the Committee by the Board | |

| | |

| | | |||

| Management Development and Compensation Committee ➢ Oversees the performance of an annual risk assessment of the Company's compensation policies and practices ➢ Reviews periodically and makes recommendations regarding the Company's risks as may be delegated to the Committee by the Board | | | Health, Safety, Security and Environmental Committee ➢ Provides input and direction to management and the Board about the Company's approach to ESG issues and HSSE policies, programs and initiatives, and reviews the Company's activities in those areas ➢ Reviews the overall adequacy of, and provides oversight with respect to, HSSE policies, programs, procedures and initiatives of the Company ➢ Reviews periodically and makes recommendations regarding the Company's risks (including, without limitation, risks relating to energy transition, emissions and climate change, as well as biodiversity matters) as may be delegated to the Committee by the Board | |

| | |

Management

Equitrans Midstream Corporation - 2021 Proxy Statement 13

Director Nominations |

The responsibilities of the Corporate Governance Committee include identifying and recommending to the Board for approval the requisite skills and characteristics to be found in individuals who will serve as members of the Board. The Committee strives to ensure that the Board consists of individuals from diverse educational and professional experiences and backgrounds who, collectively, provide meaningful counsel to management. The Corporate Governance Committee reviews the qualifications and backgrounds of the directors, as well as the overall composition of the Board, and recommends to the Board for approval the slate of directors to be recommended for nomination for election at the Company's annual meeting of shareholders.

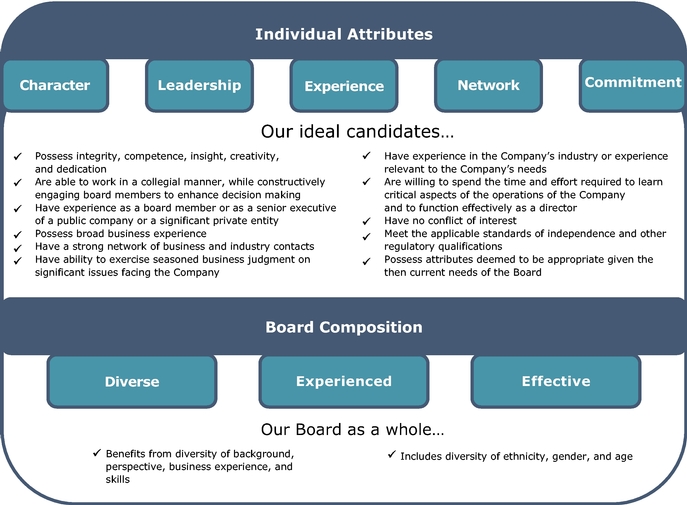

When assessing new director candidates for nomination, regardless of who recommends the candidate for consideration, the Corporate Governance Committee will consider the background, diversity, personal characteristics and business experience of the candidate against the ideal attributes identified below. Candidates generally possessing these attributes are further evaluated against of the current needs of the Company to determine the appropriate fit in light of overall Board composition. The Corporate Governance Committee reviews the attributes from time to time and recommends revisions for approval by the Board as the Corporate Governance Committee considers appropriate.

The Board initiated a search for one or more new directors in the fourth quarter of 2019. While a third-party search firm was hired to identify potential director candidates, independent directors on the Board identified Mses. Barpoulis and Collawn and Mr. Leland as potential candidates and after, among other things, a thorough vetting process, interviews with the Company's entire Board and recommendations by the Corporate Governance Committee, the Board appointed Mses. Barpoulis and Collawn and Mr. Leland to the Board effective February 1, 2020, April 1, 2020 and January 30, 2020, respectively, with terms expiring at the 2020 annual meeting of shareholders, each of whom were re-elected at such meeting. With the appointment of the three new directors, the Company has expanded its Board size to nine directors, eight of whom are independent.

14 Equitrans Midstream Corporation - 2021 Proxy Statement

As indicated in the Corporate Governance Committee's charter, the Corporate Governance Committee will consider, in its normal course, submissions from shareholders in making its recommendations for director nominees. Any shareholder desiring to recommend an individual to serve as a director of the Company should submit the information listed below to the Corporate Governance Committee Chair, care of the Corporate Secretary. The Corporate Governance Committee will consider recommendations received no earlier than the close of business on December 28, 2021, and no later than the close of business on January 27, 2022.

A submitting shareholder must provide the following:

Additionally, as set forth in Section 1.11 of the Company's Bylaws, a shareholder, or group of twenty or fewer shareholders, in each case owning continuously for at least three years as of both the date the notice is received by the Company and the record date for the annual meeting, shares of the Company representing an aggregate of at least 3% of the voting power entitled to vote in the election of directors, may nominate and include in the Company's proxy statement director nominees constituting the greater of (i) two and (ii) 20% of the Board, provided that such nominations are submitted in writing and received by the Company's Corporate Secretary not earlier than the close of business on October 16, 2021 (the 150th day prior to the first anniversary of the date that the Company mailed its proxy statement for the prior annual meeting) and not later than the close of business on November 15, 2021 (the 120th day prior to the first anniversary of the date that the Company mailed its proxy statement for the prior year's annual meeting) and include the following:

Please see "Corporate Secretary Contact Information" under the caption "Additional Information" on page 59.

Equitrans Midstream Corporation - 2021 Proxy Statement 15

Contacting the Board |

| Interested parties may communicate directly with the Lead Independent Director (and with independent directors, individually or as a group, through the Lead Independent Director) by sending an email to ETRNPresidingDirector@equitransmidstream.com. You may also write to the Lead Independent Director, the entire Board, any Board Committee, or any individual director by addressing such communication to the applicable director or directors, care of the Corporate Secretary, at Equitrans Midstream Corporation, 2200 Energy Drive, Canonsburg, Pennsylvania 15317. The Corporate Secretary will open the communication and promptly deliver it to the Lead Independent Director or the named director, unless the communication is junk mail or a mass mailing. |  |

Governance Principles |

The Company maintains a corporate governance page on its website that includes key information about its corporate governance practices, including its corporate governance guidelines, code of business conduct and ethics, and charters for each Committee of the Board. The corporate governance page can be found at www.equitransmidstream.com, by clicking on the "About" link on the main page and then on the "Governance" link. The Company will provide copies of its corporate governance guidelines, code of business conduct and ethics, and any of the Board Committee charters upon request by a shareholder to the Corporate Secretary. See "Corporate Secretary Contact Information" under the caption "Additional Information."

16 Equitrans Midstream Corporation - 2021 Proxy Statement

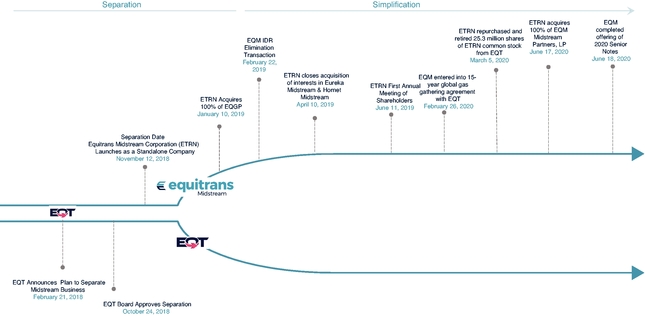

The Board is committed to strong corporate governance practices. Through the Corporate Governance Committee, the Board monitors its corporate governance policies and practices against evolving best practices. Below are highlights of some of our corporate governance policies and practices.

Corporate Governance Highlights

Shareholder Engagement |

We value feedback from our shareholders and are committed to engaging in an active dialogue with our shareholders year-round. During 2020, our management team spent a significant amount of time meeting and speaking to our shareholders. We welcome feedback from our shareholders and strive to maintain the best governance, compensation and oversight practices.

Equitrans Midstream Corporation - 2021 Proxy Statement 17

Sustainability and Corporate Responsibility |

We recognize, and appreciate, that our shareholders, employees, customers, regulators, and other stakeholders expect us to continue to focus on long-term sustainable performance, including by addressing significant, relevant ESG factors. We have, throughout our corporate history, embraced conducting business in a socially responsible and ethical manner by respecting all stakeholders, and we believe that our continued commitment to sustainability, including minimizing impacts to the environment and society, will enable us to create long-term value. We have highlighted below certain important steps that we have taken to further communicate, structure, and embed within our operations our sustainability practices.

More information regarding our sustainability initiatives and copies of our CSR for 2020 and Climate Policy are available on our website (www.equitransmidstream.com) by selecting the "Sustainability" tab on the main page. Information included in the CSR and Climate Policy is not incorporated into this proxy statement.

Independence and Related Person Transactions |

Director Independence |

The NYSE listing standards and our governance documents require a majority of our directors and each member of our Audit, Compensation and Corporate Governance Committees to be independent. For a director to be considered independent, the Board must annually determine that he or she has no material relationship with the Company except as a director. To assist it in determining director independence, the Board established guidelines that meet or exceed the independence requirements under the NYSE listing standards. These corporate governance guidelines may be found on the Company's website at www.equitransmidstream.com by clicking on "About" on the main page and then on "Governance."

The Board considers all relevant facts and circumstances in making an independence determination. Any relationship involving a Company director that complies with the independence standards included in the Company's corporate governance guidelines and is not otherwise a related person transaction under the Company's related person transaction approval policy (the related person transaction policy) is deemed to be an immaterial relationship not requiring consideration by the Board in assessing independence. In the first quarter of 2021, our Board, in coordination with our Corporate Governance Committee, made an independence determination for each of our directors and affirmatively determined that all of our directors are independent, other than Mr. Karam.

18 Equitrans Midstream Corporation - 2021 Proxy Statement

Director ownership of Company stock is encouraged and is not in itself a basis for determining that a director is not independent, provided that such ownership may preclude participation on the Audit Committee if its magnitude is sufficient to make the director an affiliated person of the Company as described in the Audit Committee charter. See "Equity-Based Compensation" under the caption "Directors' Compensation" below for a description of the stock ownership guidelines for directors.

Review, Approval or Ratification of Transactions with Related Persons |

Our Board has adopted a related person transaction policy. Under the policy, it is the responsibility of the Corporate Governance Committee to review Related Person Transactions (as defined below) not otherwise approved by the Board. Company management, with the assistance of the Company's legal department, is responsible for determining whether a transaction between the Company and a Related Person (as defined below) constitutes a Related Person Transaction. This determination is based on a review of the facts and circumstances regarding the transaction, including information provided in annual director and executive officer questionnaires. If it is determined that a transaction is a Related Person Transaction that has not been approved by the Board, the material facts regarding the transaction are reported to the Corporate Governance Committee for its review. The Corporate Governance Committee, or in certain cases the Chair of the Corporate Governance Committee followed by a report to the Corporate Governance Committee, determines whether to approve, ratify, revise, reject, or take other action with respect to the Related Person Transaction.

Under the related person transaction policy, a Related Person Transaction is generally a transaction in which the Company or a subsidiary is a participant, the amount involved exceeds $120,000, and a Related Person has a direct or indirect material interest in the transaction. A Related Person is generally any person who is a director or executive officer of the Company, any nominee for director, any shareholder known to the Company to be the beneficial owner of more than 5% of any class of the Company's voting securities, and any immediate family member (as defined by the SEC) of any of the foregoing persons.

Under the policy, the following transactions are deemed to be automatically pre-approved and do not need to be brought to the Corporate Governance Committee for individual approval:

Equitrans Midstream Corporation - 2021 Proxy Statement 19

The related person transaction policy does not limit or affect the application of the Company's code of business conduct and ethics and related policies, which require directors and executive officers to avoid engaging in any activity or relationship that may interfere, or have the appearance of interfering, with the performance of the directors' or executive officers' duties to the Company. Such policies require all directors and executive officers to report and fully disclose the nature of any proposed conduct or transaction that involves, or could involve, a conflict of interest and to obtain approval before any action is undertaken.

Related Person Transactions with Directors and Executive Officers |

No reportable transactions between the Company and any of its directors or executive officers occurred during 2020, and there are no such proposed transactions.

Related Person Transactions with EQT |

A discussion of related person transactions with EQT is attached on Appendix A to this Proxy Statement.

Compensation Committee Interlocks and Insider Participation |

No member of the Compensation Committee has served as an officer or employee of Equitrans Midstream at any time. During 2020, no Equitrans Midstream executive officer served as a member of the compensation committee or on the board of directors of any company at which a member of Equitrans Midstream's Compensation Committee or Board of Directors served as an executive officer.

20 Equitrans Midstream Corporation - 2021 Proxy Statement

DIRECTORS' COMPENSATION |

The Corporate Governance Committee reviews and the Board approves director compensation on an annual basis. No compensation is paid to employee directors for their service as directors. The Corporate Governance Committee engaged Mercer to review director compensation. Mercer performed a review of the compensation paid to our non-employee directors relative to a group of peer companies identified by Mercer and approved by the Corporate Governance Committee. In light of the non-employee directors' roles and responsibilities and after considering director compensation at relevant peer group companies, Mercer recommended the following non-employee director cash and equity-based compensation, which was approved by our Board for the 2020 and 2021 calendar years.

| Compensation Feature | 2020 | 2021 | ||

| Annual cash retainer — Board member | $100,000 | $100,000 | ||

| | | | | |

| Annual cash retainer — Committee Chair | Audit: $20,000 Compensation: $20,000 All other Committees: $15,000 | $20,000 $20,000 $15,000 | ||

| | | | | |

| Annual cash retainer — Committee member (excluding the Chair) | Audit: $7,500 Corporate Governance, | $7,500 None | ||

| | | | | |

| Annual retainer — Chairman of the Board and Lead Independent Director | Chairman: $0 Lead Independent Director: $25,000 | $0 $25,000 | ||

| | | | | |

| Deferred stock units | Value equal to $150,000 | Value equal to $150,000 | ||

| | | | | |

Equity-Based Compensation |

The Company grants to each non-employee director, on an annual basis, stock units under the ETRN LTIP, the payouts of which are deferred under Equitrans Midstream's Amended and Restated Directors' Deferred Compensation Plan (the Director Plan). Each deferred stock unit vests upon award and will be payable upon termination of service as a director of Equitrans Midstream. Each deferred stock unit is equal in value to one share of Equitrans Midstream common stock and does not have voting rights. The deferred stock unit awards are automatically deferred into the Director Plan, and dividends thereon are credited quarterly in the form of additional deferred stock units.

Newly elected non-employee directors of Equitrans Midstream are generally expected to receive an equity grant upon joining the Board equal to the pro-rata amount of the then applicable annual grant. Accordingly, Mses. Barpoulis and Collawn and Mr. Leland received pro-rated grants of 14,200, 8,440, and 13,970 deferred stock units, respectively, when they joined the Board on February 1, 2020, April 1, 2020, and January 30, 2020, respectively.

Deferred Compensation |

The Company maintains the Director Plan. Under the Director Plan, in addition to the automatic deferral of deferred stock unit awards, non-employee directors are permitted to elect to defer up to 100% of their retainers and any fees into the Director Plan and receive an investment return on the deferred funds as if the funds were invested in Company common stock or permitted mutual funds. Prior to the deferral, plan participants are required to irrevocably elect to receive the deferred funds either in a lump sum or in equal annual installments. Deferred funds for which directors have elected to receive an investment return as if the funds were invested in Company common stock will be distributed in shares of Company common stock. Distributions will be made or, if applicable, commence following termination of service as a director. The directors' deferred compensation accounts are unsecured obligations of the Company. Mr. Szydlowski and Ms. Collawn deferred fees under the Director Plan during 2020.

Equitrans Midstream Corporation - 2021 Proxy Statement 21